Hello!

Stocks had another strong week, finishing higher by about 2.3% Both SPX and SPY got stuck in the mud for the final 3 days of last week as they reached a heavy open interest level of 450/4500 and the gamma took effect, essentially pinning the indices to that level as November monthly options approached expiry. With those monthly options expired the backdrop changes into this week, but it also happens to be a shortened Thanksgiving week. Therefore, options are pricing a small move, a bit less than 1% into Friday. It’s possible that gamma get re-established at the same level but it is unlikely we see that sort of gamma pinning we saw last week as the effect won’t be as robust to start a new option calendar month.

The big economic data of the week comes on Tuesday with the release of the FOMC minutes. Fed watchers’ attention turns now from rate hikes, with the assumption those are now over, to any signs of cracks in the economy which could allow the FOMC to begin cutting rates in 2024. As of now Fed fund futures give a small chance of a rate cut by March with a strong chance of one happening by May. That’s something to keep an eye on as talk of rate cuts would likely coincide with worries about an economic cooldown. That table has not turned yet but it could become the focus into year end.

The earnings calendar is highlighted this week by Zoom and Nvidia, with some more large retailers also weighing in.

Weekly Expected Move

- SPX/SPY 0.9%

- QQQ 1.4%

0DTE/Daily Expected Moves

- SPX/SPY 0.5%

- QQQ 0.7%

Economic Calendar

- Tuesday – FOMC Minutes

- Wednesday – Durable Goods, Initial Jobless Claims

- Friday – S&P Global PMI

Earnings Expected Moves (Options AI Calendar)

The big economic data of the week comes on Tuesday with the release of the FOMC minutes. Fed watchers’ attention turns now from rate hikes, with the assumption those are now over, to any signs of cracks in the economy which could allow the FOMC to begin cutting rates in 2024. As of now, Fed fund futures give a small chance of a rate cut by March with a strong chance of one happening by May. That’s something to keep an eye on as talk of rate cuts would likely coincide with worries about an economic cooldown. That table has not turned yet but it could become the focus into year end.

- ZM Zoom Video Communications, Inc. 7.8%

- A Agilent Technologies, Inc. 6.9%

- KEYS Keysight Technologies, Inc. 7.4%

Tuesday

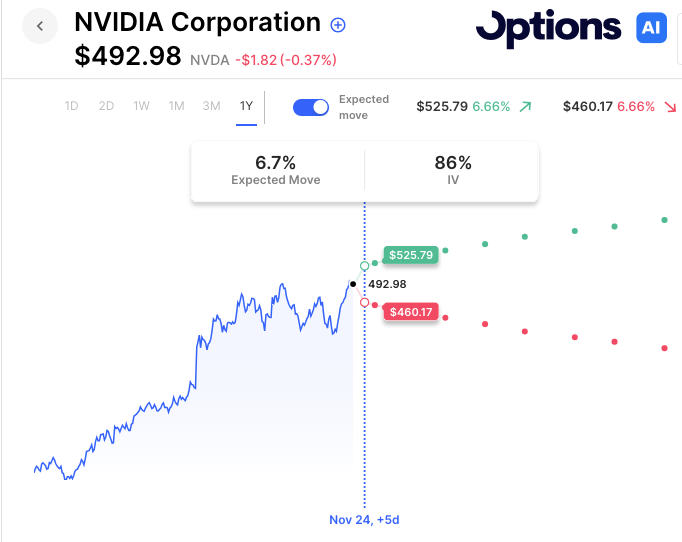

NVDA NVIDIA Corporation 6.7%

- LOW Lowe’s Companies, Inc. 3.8%

- BIDU Baidu, Inc. 5.6%

- HPQ HP Inc. 6.3%

- BBY Best Buy Co., Inc. 6.1%

- DKS DICK’S Sporting Goods, Inc. 8.1%

- ANF Abercrombie & Fitch Co. 12.1%

- KSS Kohl’s Corporation 10.8%

- JWN Nordstrom, Inc. 11.6%

- URBN Urban Outfitters, Inc. 7.8%

Wednesday

- DE Deere & Company 4.1%

Full lists here: Options AI Free Tools.

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC