Hello!

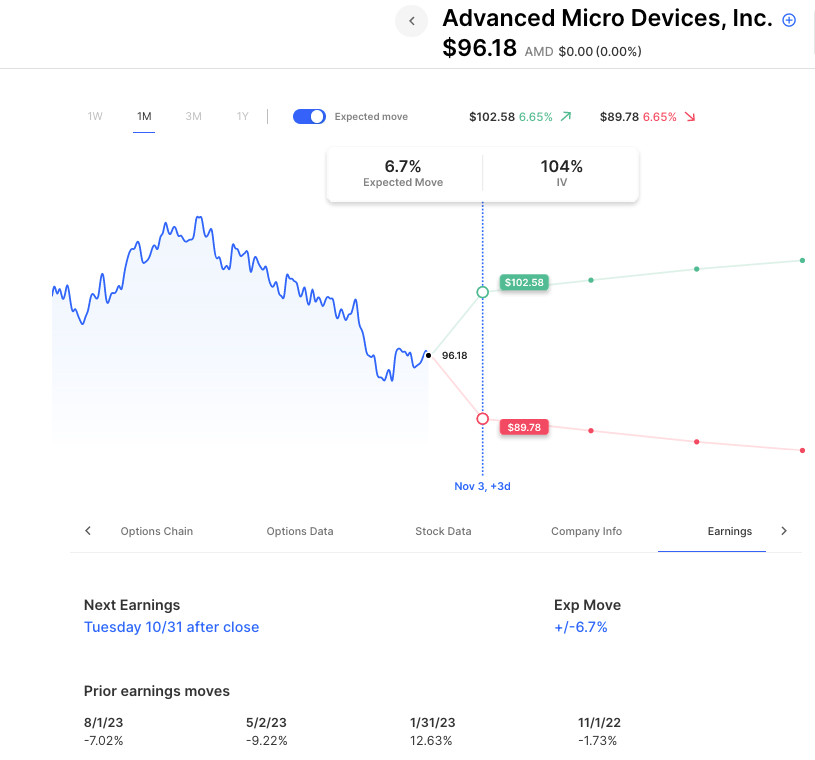

The major indices aren’t showing their hand early after the rally yesterday. We’ll have to see how they decide to end the month, which will be the 3rd straight down month for stocks. AMD reports earnings after the close. Right now options are pricing an almost 7% move. Recent earnings have seen moves -7%, -9%, +13% and -2%. Intel recently reported and the stock moved sharply higher.

IV for Friday’s options are about 105, with 30-day IV about half that. The 30-day realized vol (how much the stock has been moving into earnings) is just 39, much less than the 1-year realized vol of 49. Although that realized vol has picked up in the past week with the stock down 7%. The stock is now down about 27% from its highs this Summer.

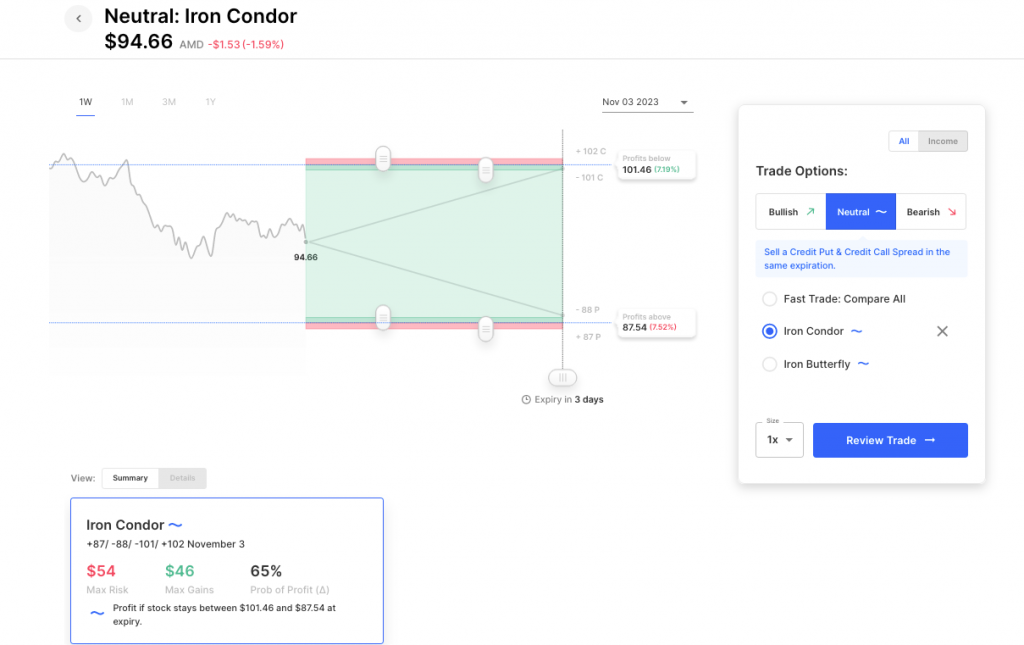

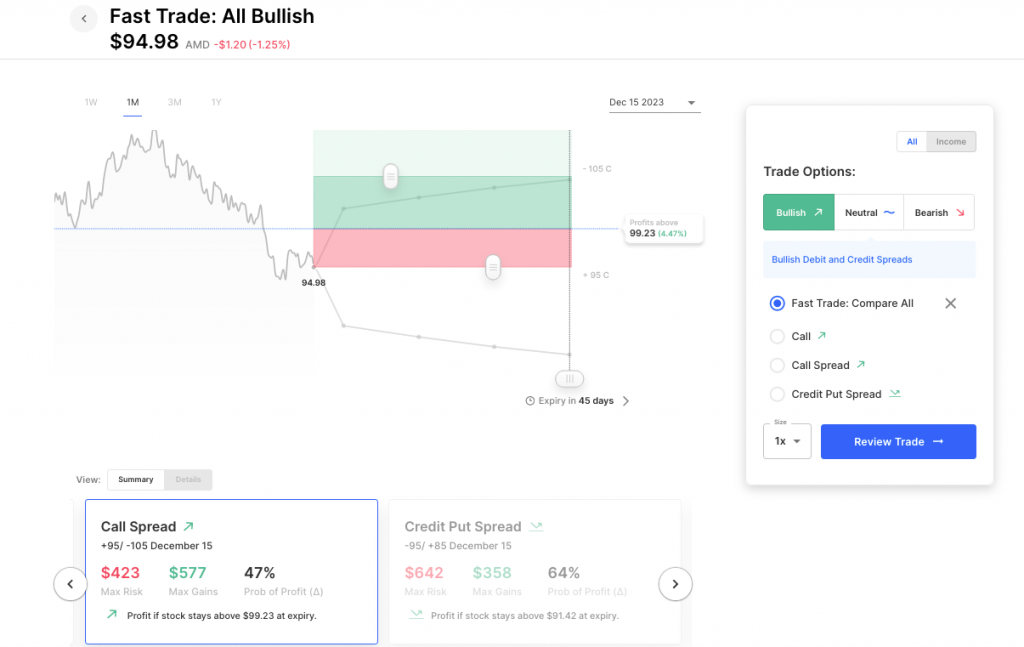

An Iron Condor selling the move (at the expected move for the week) puts the upper breakeven (101.50) above that big round number of 100 (which also has heavy open interest). A bullish call spread out to December expiry needs the stock above 100 to make significant profits (breakeven 99ish). In other words, see the importance of 100 if the stock were to go higher in the trade images below. It may be the level that decides a lot of winning and losing positions.

Trending

- Sarepta Therapeutics (SRPT) -41.94%

- Scisparc Ltd (SPRC) +124.03%

- Tesla Inc (TSLA) -1.00%

- Pinterest Inc (PINS) +16.02%

- Sofi Technologies Inc (SOFI) +1.59%

- Jetblue Airways Cp (JBLU) -7.86%

- BP Plc ADR (BP) -3.94%

- Amgen Inc (AMGN) -1.02%

- Pfizer Inc (PFE) -0.82

- Lyft Inc Cl A (LYFT) -4.24%

- Caterpillar Inc (CAT) -4.88%

Today’s Earnings:

- Advanced Micro Devices, Inc. (AMD) Expected Move: 6.63%

- First Solar, Inc. (FSLR) Expected Move: 8.98%

- Paycom Software, Inc. (PAYC) Expected Move: 10.50%

- Match Group, Inc. (MTCH) Expected Move: 7.52%

- Lumen Technologies, Inc. (LUMN) Expected Move: 10.84%

Full list here: Options AI Earnings Calendar

Unusual Options Volume

ON (+1253%), GGAL (+1108%), PINS (+922%), FSLR (+617%), JBLU (+613%), MTCH (+603%), WDC (+578%), TSLA (+546%), SOFI (+545%), F (+536%), ENPH (+510%), SAVE (+490%), CZR (+483%), CAT (+452%), MSTR (+432%), NVDA (+360%), OSTK (+352%)

Looking Ahead

Economic Calendar

- Wednesday – ADP Employment, ISM Manufacturing, FOMC Rate Decision, FOMC Press Conference

- Friday – NFP Payrolls, ISM Services

Earnings

Wednesday

- NVO Novo Nordisk A/S 4.6%

- ABNB Airbnb, Inc. 8.1%

- HUM Humana Inc. 3.8%

- PYPL PayPal Holdings, Inc. 8.7%

- MNST Monster Beverage Corporation 5.6%

- ET Energy Transfer LP 2.8%

- MCHP Microchip Technology Incorporated 8.3%

- YUM Yum! Brands, Inc. 4.5%

- DASH DoorDash, Inc. 8.3%

Thursday

- AAPL Apple Inc. 3.9%

- LLY Eli Lilly and Company 5.0%

- SBUX Starbucks Corporation 5.2%

- BKNG Booking Holdings Inc. 5.4%

- REGN Regeneron Pharmaceuticals, Inc. 4.2%

- SHOP Shopify Inc. 9.4%

- MELI MercadoLibre, Inc. 7.4%

- PLTR Palantir Technologies Inc.11.8%

- MRNA Moderna, Inc. 9.1%

Friday

- UI Ubiquiti Inc. 16.1%

- IMGN ImmunoGen, Inc. 14.0%

- FUBO fuboTV Inc. 16.1%

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC