Hello!

Headlines

- Indices flat to start the day

- VIX back down to 15 into the holiday weekend but GDP and Jobs Number come before that and could move the market

- SPY expected move: Today: 0.5% Til Friday: 1.0%

- QQQ expected move: Today: 0.7% Til Friday: 1.5%

Salesforce reports tomorrow after the close. The expected move of 6% is at the lower end of the range of recent reports but more than the actual move on the last report (-5%, +12%, -8%). Options expiring Friday are about 78 IV, with 30-day out options about 39 IV. The stock has been quiet into the report with the past 30-day actual vol just 23 (compared to the past year’s actual/realized vol of 36).

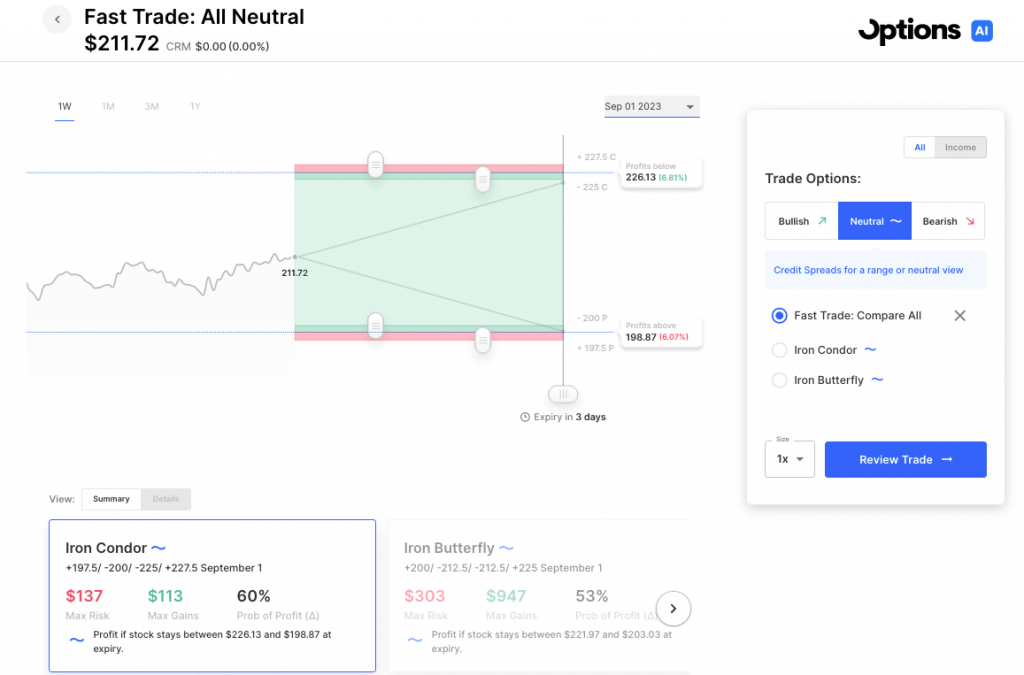

Here’s a peek at an Iron Condor set at the expected move (based on yesterday’s close), risking about 140 to make 110. More on that tomorrow, as well as CRWD, OKTA and more.

Trending Early:

- Tivic Health Systems Inc (TIVC) +96.90%

- Nio Inc ADR (NIO) -6.53%

- Pdd Holdings Inc (PDD) +12.32%

- Hawaiian Electric Industries (HE) +2.58%

- Tesla Inc (TSLA) -0.51%

- Nvidia Corp (NVDA) -0.63%

- Lucid Group Inc (LCID) -0.49%

- Futu Holdings Ltd ADR (FUTU) +3.67%

- Rivian Automotive Inc Cl A (RIVN) -0.24%

Today’s Earnings Highlights:

- HP Inc. (HPQ) Expected Move: 4.15%

- Hewlett Packard Enterprise Company (HPE) Expected Move: 6.66%

- Box, Inc. (BOX) Expected Move: 5.59%

- Ambarella, Inc. (AMBA) Expected Move: 8.20%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 10:00 AM (EST) CB Consumer Confidence (Aug) Estimates: 116, Prior: 117

- At 10:00 AM (EST) Pending Home Sales YoY (Jul) Impact: Medium

Scanner Highlights:

- Overbought (RSI): HZNP (86), SGEN (82), SPLK (76), CSCO (69), IBM (67)

- Oversold (RSI): M (17), JWN (21), FCEL (21), CHWY (21)

- High IV: WE (+483%), HE (+190%), BB (+174%), FCEL (+162%)

- Unusual Options Volume: BBY (+1108%), HE (+717%), PDD (+526%), FUTU (+510%), NVAX (+495%), CRWD (+489%)

Full lists here: Options AI Free Tools.

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.